City of Sedalia Sets Property Tax Rates for 2021

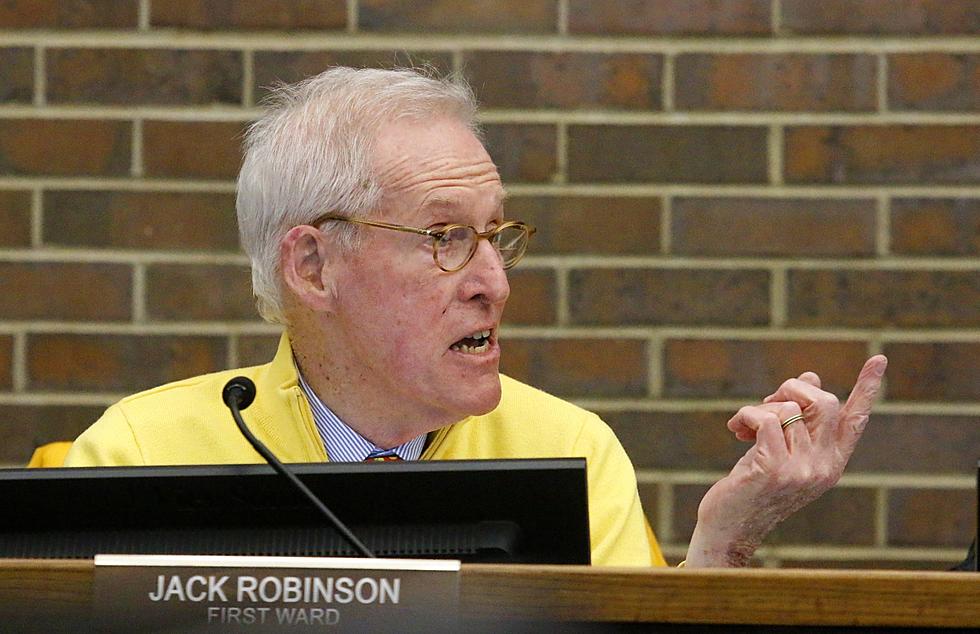

A public hearing concerning property tax rates in the City of Sedalia received no comments Monday night during a special meeting held by City Council.

The tax rates are set to produce the revenues for the fiscal year that began April 1, 2021.

Each tax rate is determined by dividing the amount of revenue required by the current assessed valuation. The results is then multiplied by 100 so that the tax rate will be expressed in cents per $100 of valuation.

Property located outside the Special Business District and Public Library will be assessed at $0.7810 per $100 assessed valuation.

Property located outside the Special Business District, but within the Public Library will be assessed at $1.0825 per $100 of assessed valuation.

Property located within the Special Business District and Public Library will be assessed at $1.9093 per $100 assessed valuation.

City Administrator Kelvin Shaw explained that “every year we have to go through the process prescribed by the Hancock Amendment, where we can only realize as much revenue out of the property tax levies, based off of the Consumer Price Index and new property.

“That keeps us from artificially raising the assessed valuations and collecting more revenues. This process basically keeps you from doing that. It takes the assessed valuations, divides that into the amount of revenue that you can legally obtain through the Hancock Amendment. That sets what the levy can be. So the more the assessed valuations go up, the lower the levy, but it equals the same revenue. And vice versa,” Shaw noted.

“The state auditor's office is in charge of making sure we all calculate that correctly. So they put out pro formas, or spread sheets, and we just plug in the assessed valuations, and it spits out what we can do,” Shaw explained.

The amount dropped about 3-and-a-half cents from last year.

“That's about what it should be,” Shaw concluded.

The open Council meeting was followed by a 45-minute closed session to discuss legal advice, real estate and or personnel.

Second Ward Council member Tina Boggess and Third Ward Councilman Bob Cross were absent from Monday's special meeting. Council meets again Sept. 7, after Labor Day.

Editor's note: The Constitution of Missouri was amended in 1980 to add Article X, Sections 16 through 24, commonly referred to as the Hancock Amendment.

This tax limitation amendment imposes restrictions on the amount of

personal income used to fund state government and the amount by which

fees and taxes can be increased. Mathematical formulas are used to

determine the relevant threshold amounts each year.

The Hancock Amendment limits the amount of Missourians' personal

income that may be used to fund state government to no greater than the

portion used to do so in 1981. In other words, since 5.6 percent of

Missourians' personal income went to fund state government in 1981, then

no more than 5.6 percent can be used to do so in future years, unless

revenues are specifically excluded by a vote of the people.

The Hancock Amendment also requires voter approval before taxes or fees

can be increased by the General Assembly beyond a certain annual limit.

Based upon the calculation provided by the Office of Administration,

Division of Budget and Planning, the relevant annual revenue limit for fiscal

year 2012 was $84.2 million.

--Source: Missouri State Auditor

More From KIX 105.7